oklahoma franchise tax instructions

Round to four decimal points. Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now.

13 Things You Need To Know About Llc Taxes Toggl Blog

Instructions for completing the Form 512 512 corporation.

. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Percent of Oklahoma assets to total net assets line 1 divided by line 2. Build an Effective Tax and Finance Function with a Range of Transformative Services.

Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. To make this election file Form 200-F.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Determine the amount of franchise tax due. To make this election file Form 200-F.

On the Oklahoma Tax Commission website go to the Business Forms page. Learn How EY Can Help. Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO.

For a corporation that has elected to change its filing period to match its fiscal year the franchise. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. The franchise tax is waived for revenue and assets of less than 200000 and is capped at 20000.

Scroll down the page until you find Oklahoma Annual Franchise Tax. CARS - Online Renewal. Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains.

Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. To make this election file Form 200-F.

Use Tax - Individual. Oklahoma franchise tax is due and payable each year on July 1. Corporations that remitted the maximum.

The maximum annual franchise tax is 2000000. Mail your return to. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Line 12 Tax Enter the amount calculated at 125 for each 100000 of. Allocated or employed in Oklahoma. Mail your return to.

The rules legislation and. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Corporations that remitted the maximum.

To file your Annual Franchise Tax by Mail. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. To make this election file Form 200-F.

When is franchise tax due. Ad Corporate Tax Services and Solutions from EY. Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any attachments.

Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

Pay Federal Taxes Online With Paypal Payusatax Paypal

Why Do You Need To Hire Employment Lawyer In 2022 Family Law Attorney Attorney At Law Family Law

Can Tax Preparers Be Liable For Tax Mistakes Rjs Law

Singapore Corporate Tax How To Pay Tax Rate Exemptions Singaporelegaladvice Com

Disposable Plastic Bag Tax Begins In 5 Virginia Localities Starting January 1 2022 Virginia Tax

Thinking Of Selling On Amazon Marketplace Here Are The Pros And Cons

State Pte Tax Elections Status And Issues To Consider Bdo

Pay Federal Taxes Online With Paypal Payusatax Paypal

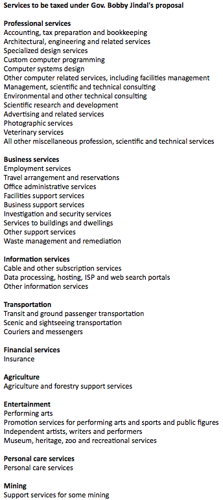

Jindal Tax Plan Unveiled To Legislators Local Politics Nola Com

State Of Michigan Taxes H R Block

Are State Tax Refunds Taxable The Turbotax Blog

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Oklahoma Taxpayer Access Point

Where S My Refund How To Track Your Tax Refund 2022 Money

Here Are Some Last Minute Tips As The April 18 Tax Filing Deadline Nears

Are State Tax Refunds Taxable The Turbotax Blog

Indiana Pacers Make Necessary Yet Humiliating Move And Fire Head Coach Nate Bjorkgren After One Season

The Difference Between Nonprofit And Tax Exempt Status Insights Venable Llp